Eyeballing

Risk Analysis Limited

18 January 2004. Thanks to A.

The Sunday Times (UK)

January 18, 2004

Robert Winnett and David Leppard

THE government has hired a detective agency to uncover the mole behind leaks to The Sunday Times which exposed the secrets of the honours system.

The mole hunt, which security consultants say could cost hundreds of thousands of pounds, has been condemned as “a waste of taxpayers’ money” by senior Whitehall insiders.

It is believed to be the first time a private agency has been hired to conduct a government leak inquiry. The company is expected to charge the Cabinet Office at least £5,000 a day.

News of the contract comes only days before the government is expected to be criticised by Lord Hutton for the way it pursued another whistleblower, Dr David Kelly, the government weapons scientist.

The Sunday Times revealed last month that nearly 300 people, including dozens of famous names, had refused honours.

The leaked Cabinet Office documents also showed that mandarins decided to give Tim Henman, Britain’s top tennis player, an OBE simply because his name would “add interest” to a lacklustre new year’s honours list.

The main honours committee of senior civil servants denied a knighthood to Colin Blakemore, the eminent scientist, because it felt his work on vivisection was too “controversial” — even though it was publicly supported by ministers.

The disclosures forced the government to announce an inquiry into ways of making the system more transparent and fair.

This weekend, further Whitehall documents leaked to The Sunday Times revealed Risk Analysis has been hired by the Cabinet Office to interrogate civil servants.

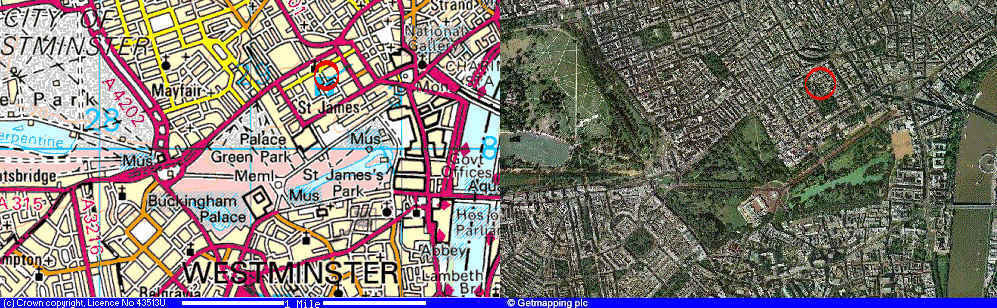

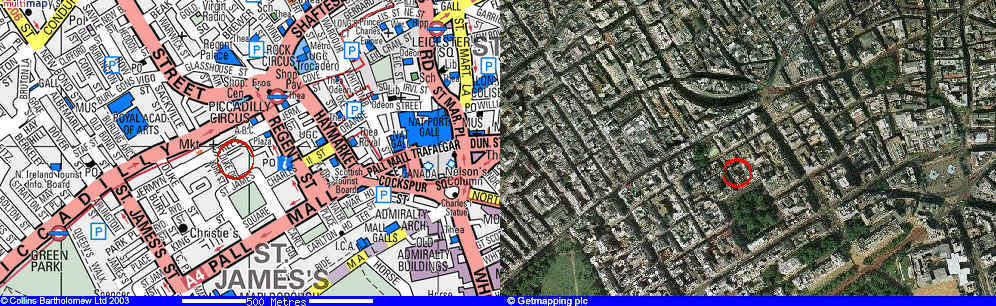

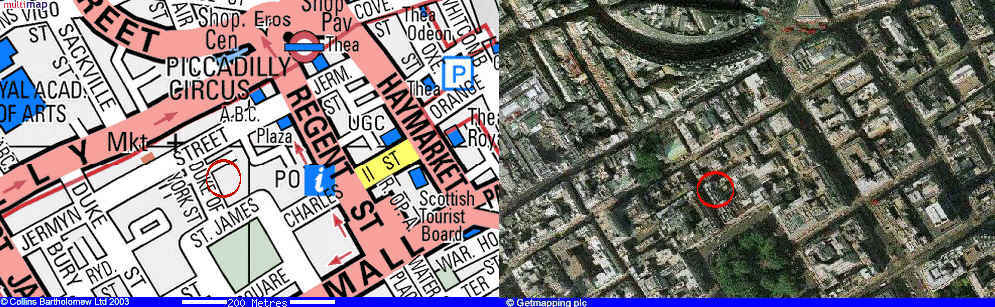

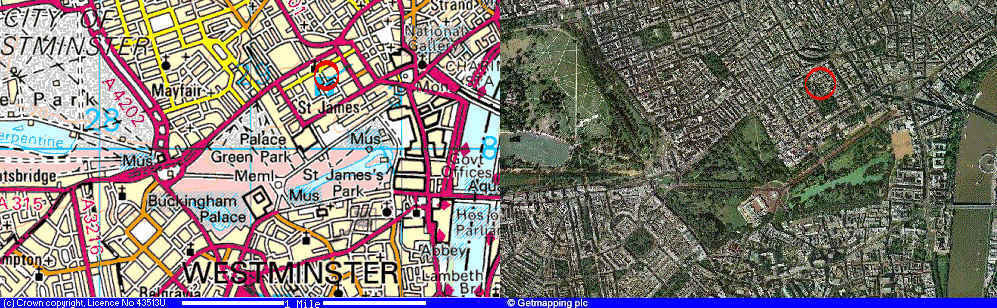

The company has offices in London’s Mayfair, Luxembourg and Switzerland and has a track record of corporate investigations in Russia and the Middle East.

It is headed by Christopher Davy, CB, who spent more than 26 years in the intelligence services. He has been described as having worked for “the Ministry of Defence”, but Whitehall sources say he worked for MI5.

Martin Flint, the company’s managing director, was for 20 years an intelligence officer with MI5, where he became one of its most senior officials. Both men were unavailable for comment yesterday.

The document, marked “restricted” and circulated in Whitehall, said Davy would be leading the inquiry into the “serious and damaging leak” of a “significant amount of sensitive material”.

The team of former intelligence officers is currently drawing up lists of civil servants who had access to the leaked information.

That number could run into several hundreds. According to one document, the team will then conduct dozens of initial fact-finding interviews to decide who should be probed further in four-hour-long interrogations.

The investigation is understood to have been authorised by senior ministers despite the fact that the leaks pose no threat to national security.

A senior member of the government’s D-notice committee, which monitors potential breaches by the media of official secrets laws, said the use of an outside agency to investigate leaks of government information was “extremely bizarre”.

“The Cabinet Office appears to be conducting a witch-hunt against someone who quite properly blew the whistle. In terms of the public interest, this was a valid story from someone who believed the system had become politicised and corrupt.”

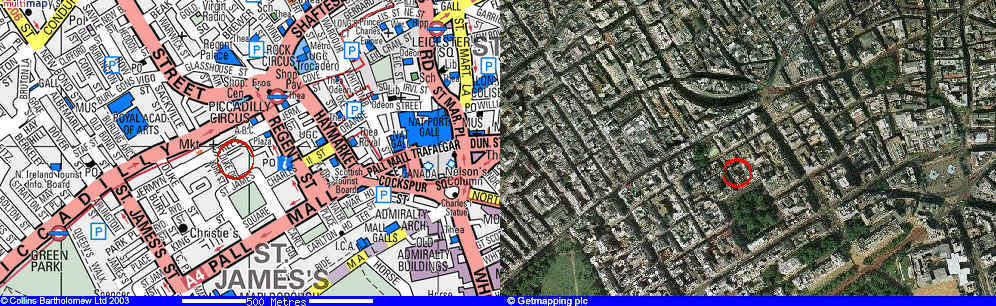

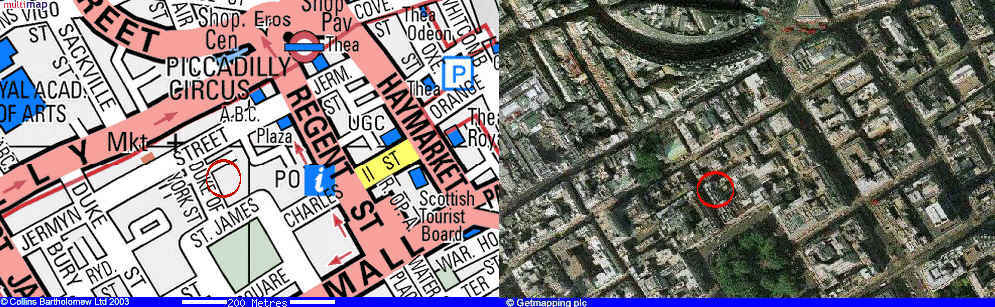

Ground level photos of the Risk Analysis property welcomed. Send to jya@pipeline.com

RISK ANALYSIS (UK) LIMITED

7 APPLE TREE YARD

LONDON

SW1Y 6LD

http://www.risk-analysis.org

|

|

|

|

Company Name RISK ANALYSIS (UK) LIMITED

Registered Number 03604666

Registered Address 7 APPLE TREE YARD

LONDON

Post Code SW1Y 6LD

Type Private Limited

Incorporation date 27/07/1998

Type of Accounts Total Exemption Small

__________________________________________

Annual Accounts 04/02-03/03

Change 04/01-03/02

Change 04/00-03/01

Months 12 - 12 - 12

Currency GBP - GBP - GBP

Consolidated A/cs N - N - N

Turnover - - -

- -

Pre tax profit -

- -

- -

Profit after tax - - - - -

Stock -

- -

- -

Cash 186,000

933.3% 18,000

100.0% 9,000

Total Fix Assets 6,000

- 6,000

20.0% 5,000

Total Current Assets 322,000

403.1% 64,000

-53.6% 138,000

Total Assets 328,000

368.6% 70,000

-51.0% 143,000

Total current liabilities 95,000

196.9% 32,000

-67.0% 97,000

Total long term liabilities - - - - -

Paid up equity - - - - -

Reserves - - - - -

Shareholders funds 233,000 513.2% 38,000 -17.4% 46,000

No Of Employees - - - - -

Key Ratios

04/02-03/03 04/01-03/02 04/00-03/01

Pre-tax profit margin - - -

Current ratio 3.39 2.00 1.42

Sales/ Net working capital 0.00 0.00 0.00

Gearing % 0.0% 0.0% 0.0%

Equity in % 71.0% 54.3% 32.2%

Profitability

Liquidity

Shareholders Funds

_______________________________________

Name RISK ANALYSIS (UK) LIMITED

Number 03604666

Rating (0 to 100)

79 Very Good Credit Worthiness

Last Changed 08/11/2002

Rating History

Date Rating Description

08/11/2002 79 Very

Good Credit Worthiness

30/01/2002 69 Good

Credit Worthiness

10/12/2001 58 Good

Credit Worthiness

15/11/2001 58 Good

Credit Worthiness

08/09/2001 58 Good

Credit Worthiness

Rating Explanation

Rating Description

71-100 Very Good

Credit Worthiness

51-70 Good Credit

Worthiness

40-50 Credit Worthy

21-39 Credit Against

Collateral

0-20 Not Credit

Worthy

Newly estabished

Company's age is less that 18 months

Liquidated/Wound-up

Company is liquidated or is wound-up

Dissolved Company

is dissolved

Petition Petition

has been filed

Credit Limit £ 30,000

____________________________________________________

Telephone Number 0207 024 8350

Fax Number 0207 024 8351

Registered Address 7 APPLE TREE YARD

Trading Address 11 Waterloo Place

LONDON

Post Code SW1Y 6LD

Post Code SW1Y 4AU

Region Region 14

Previous Name(s)

Company Type Private Limited

Type of Accounts Total Exemption Small Incorporation Date

27/07/1998

Annual Return Date 01/07/2003 Date of Latest Accounts 31/03/2003

SIC Code - Description 74600

Industry

_______________________________________

Profit & Loss Account

Annual Accounts 04/02-03/03 Change

04/01-03/02 Change 04/00-03/01

Months 12 - 12 - 12

Currency GBP - GBP - GBP

Consolidated A/cs N - N - N

Turnover - - -

- -

Export -

- -

- -

Cost of Sales -

- -

- -

Gross Profit -

- -

- -

Wages & Salaries -

- -

- -

Directors Emoluments -

- -

- -

Operating Profits -

- -

- -

Depreciation -

- -

- -

Audit Fees -

- -

- -

Interest Payments -

- -

- -

Pre tax profit -

- -

- -

Taxation -

- -

- -

Profit after tax - - - - -

Dividends Payable -

- -

- -

Retained Profits -

- -

- -

_________________________________

Balance Sheet Items

Annual Accounts 04/02-03/03

Change 04/01-03/02 Change 04/00-03/01

Tangible Assets 6,000

- 6,000

20.0% 5,000

Intangible Assets -

- -

- -

Total Fix Assets 6,000

- 6,000

20.0% 5,000

Total Current Assets 322,000

403.1% 64,000

-53.6% 138,000

Trade Debtors 136,000

195.7% 46,000

-64.3% 129,000

Stock -

- -

- -

Cash 186,000

933.3% 18,000

100.0% 9,000

Other Current Assets 186,000

933.3% 18,000

100.0% 9,000

Net Cash 186,000

933.3% 18,000

100.0% 9,000

Increase in Cash -

- -

- -

Liquid Assets 322,000

403.1% 64,000

-53.6% 138,000

Miscellaneous Current Assets -

- -

- -

Total Assets 328,000

368.6% 70,000

-51.0% 143,000

Total current liabilities 95,000

196.9% 32,000

-67.0% 97,000

Trade Creditors 95,000

196.9% 32,000

-67.0% 97,000

Bank Overdraft -

- -

- -

Other Short Term Fin -

- -

- -

Miscellaneous Current Liabilities -

- -

- -

Other Long Term Fin -

- -

- -

Total long term Liabilities -

- -

- -

Bank Overdraft & LTL -

- -

- -

Total Liabilities 95,000

196.9% 32,000

-67.0% 97,000

Net Assets 233,000

513.2% 38,000

-17.4% 46,000

Working Capital 227,000

609.4% 32,000

-22.0% 41,000

_________________________________

Capital & Reserves

Annual Accounts 04/02-03/03

Change 04/01-03/02

Change 04/00-03/01

Paid up equity -

- -

- -

P&L Account Reserve 213,000

460.5% 38,000

-17.4% 46,000

Sundry Reserves - - - - -

Revaluation Reserve -

- -

- -

Share Capital & Other Reserves 20,000

- -

- -

Shareholders funds 233,000

513.2% 38,000

-17.4% 46,000

Net Worth 233,000

513.2% 38,000

-17.4% 46,000

______________________________________________

Miscellaneous

Annual Accounts 04/02-03/03

Change 04/01-03/02 Change

04/00-03/01

Net Cashflow from Operations -

- -

- -

Net Cashflow before Financing -

- -

- -

Net Cashflow from Financing -

- -

- -

Contingent Liability -

- -

- -

Capital Employed 233,000

513.2% 38,000

-17.4% 46,000

No Of Employees -

- -

- -

Auditors

Audit Qualification

Bankers

Bank Branch Code

_______________________________________________

Ratios Key Ratios

04/02-03/03 04/01-03/02 04/00-03/01

Pre-tax profit margin % - - -

Current ratio 3.39 2.00 1.42

Sales/ Net working capital 0.00 0.00 0.00

Gearing % 0.0% 0.0% 0.0%

Equity in % 71.0% 54.3% 32.2%

Creditors Days - - -

Debtors Days - - -

Liquidity/Acid Test 3.39 2.00 1.42

Return on Capital Employed % 0.0% 0.0% 0.0%

Return on Total Assets Employed % 0.0% 0.0% 0.0%

Current Debt Ratio % 0.4% 0.8% 2.1%

Total Debt Ratio % 0.4% 0.8% 2.1%

Stock Turnover Ratio % - - -

Return on Net Assets Employed % 0.0% 0.0% 0.0%

____________________________________________

Name CHRISTOPHER JOHN BERNARD DAVY

Officers title

Date of Birth 25-07-1935

Honours CB

Address

PO BOX 2661

SHERBORNE

DORSET

Nationality BRITISH

Directorships

Org.number Company Name Status Function

03604666 RISK ANALYSIS (UK) LIMITED Director

Name LUCY CARMEL GOW

Officers title

Date of Birth 26-08-1965

Honours

Address

HOLLY HOUSE

WHILTON

DAVENTRY

NORTHAMPTONSHIRE

Nationality BRITISH

Directorships

Org.number Company Name Status Function

03604666 RISK ANALYSIS (UK) LIMITED Director

03604666 RISK ANALYSIS (UK) LIMITED Secretary